Wine customers are like oranges. They come in segments

Let's look at some of the wine tribes out there. Not the Sunday Supplement sort - like "bopeas". The kind of segments you can use to sell more wine, for more money, to more people.

Okay… if you’re new here (or just forgot) this is the weekly wine marketing masterclass. A COMPLETE MBA course in wine marketing. For $100. (A full wine MBA costs up to €30,000). We’ve already learned that there’s no such thing as the “wine consumer” and today we’ll look at what different “flavours” wine drinkers come in. And how you can use them to sell more wine, more profitably. But just to catch you up we’ve already covered a LOT.

In Market Orientation we looked at…

What Google image searches get wrong about wine lovers

Do you need a trust fund to enjoy wine?

The wine drinker is not a “consumer”… she’s your mum

The “very rare trait” that makes you successful

In Market Research we looked at…

Even more on the dangers of relying on statistics

In wine it pays to ask weird questions

And in Segmentation we’ve looked at…

if Gen Z is the new “millennials

why for two days a month we’re all millionaires

So today… let’s look at why wine customers are like oranges.

Like an orange you can cut wine drinkers in different ways

PROOF Insight is a division of C&C Group in the UK. They’re commissioned by clients to produce different forms of market segmentation. if you like to “cut” the market in different ways. And they have particular tools depending on the segmentation you need.

OUTLET is a geographical segmentation tool. It collects data on where on-trade licence outlets are, what they offer, and the competitive environment they occupy.

PRODUCT looks at pricing segmentation. It answers questions about how much people are charging for drinks and wines - like yours say, or like the wine you're proposing to launch - into different parts of the UK on-trade market.

OCCASIONS creates segments according to... you've guessed it, occasion. Who drinks what, when, with whom? It’s designed to help wine and spirits brands figure out where their product can fit in a drinkers' life.

And these all come together in POURTRAITS, bringing together behavioural segmentation, attitudinal segmentation, demographic segmentation, and data on spending segments. This answers those key questions, like who should my target audience be? What do they want to drink and why? How can I innovate to appeal to them with new products, rebrands or range extensions?

Okay I can’t afford commissioning research, can you give me some useful pointers?

Yes. It’s not quite the same. But actually it’s really helpful to think of meaningful ways of breaking down the wine market in the countries or communities where you sell.

The reports you are looking for will often look like this…

Have a good look. You’re one of those. My name is Joe Fattorini, and I am “Suburban Splendour”

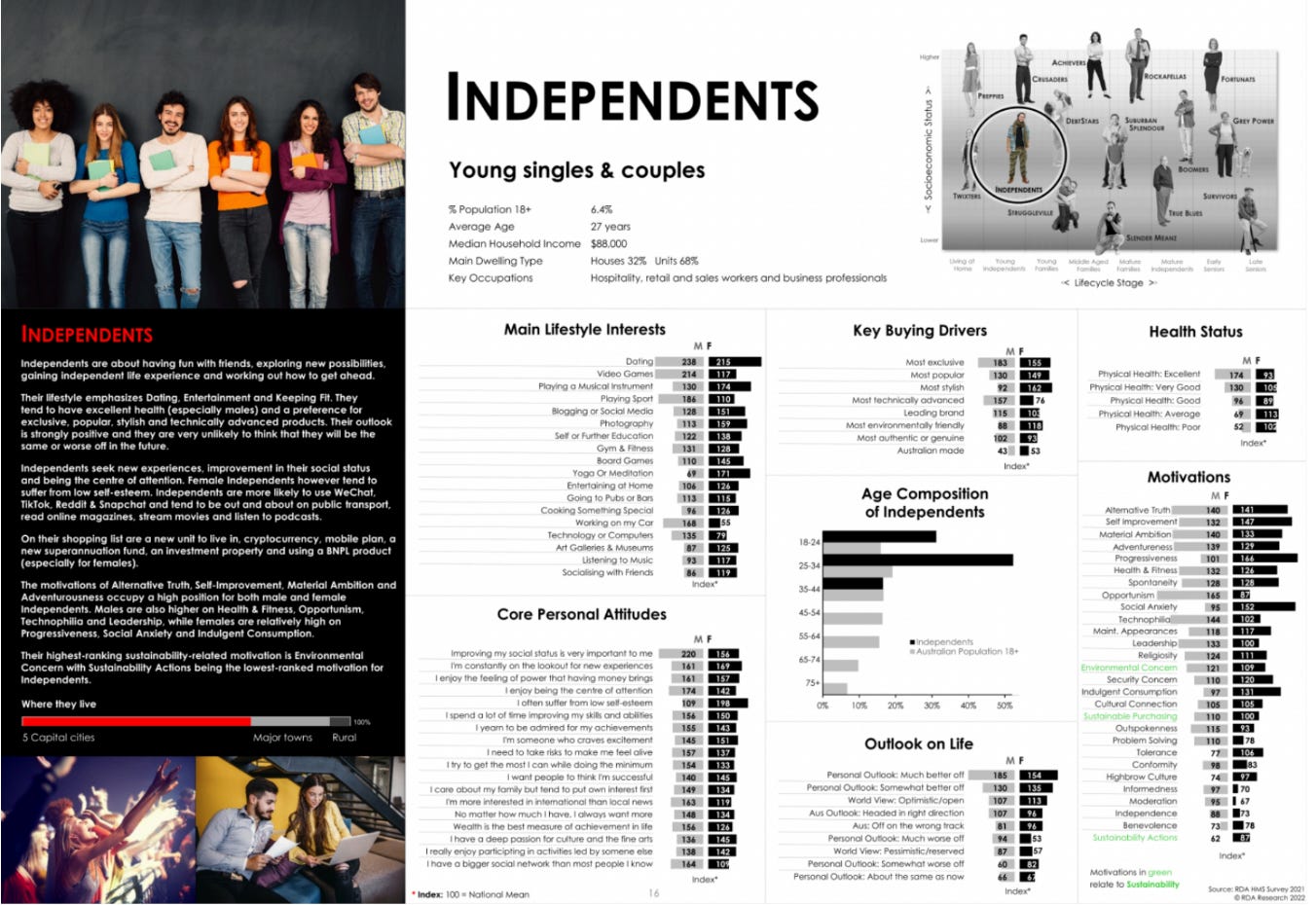

This is the segmentation of RDA Research's GeoTribes. It’s a consistently updated survey of US consumer types. And they're laid out here according to their socioeconomic status on the vertical axis, and lifecycle stage on the horizontal axis. How rich they are. And how old they are. Each segment has a name – and that refers to more of the psychographic features that mark out the segment.

RDA Research publishes a great deal of data about each one of those segments. Giving you attitudes, behaviours, drivers, motivations, and interests typical of that group – and remember – distinctive from other groups. If you want to understand what each group is like, how it tends to behave, what it tends to believe, what motivates them, and why they buy things… this is a great place to start.

Wine businesses have published a range of studies that follow a similar pattern. And even if you don't perform your own complete segmentation, you should look for segmentations that give you insights into your chosen market.

The Wine Genome Project was a segmentation performed by Constellation Brands around eight years ago. It found six distinctive segments. And this is typical for most market segmentations. You're looking for six to ten segments.

And you can find some interesting features. Enthusiasts only contributed around 15% of the wine sector's profits. Everyday Loyals are the wine drinkers for whom wine takes up the largest share of their overall alcohol consumption. Contrast the 20% of wine drinkers who are Everyday Loyal and the 21% who are Price Driven. And the huge difference in profitability between them.

More recently in the UK Bibendum-PLB created a set of eight consumer portraits. And helpfully laid them out here with the size on the graph showing their relative size as a proportion of the total audience for wine. And you can see some themes. Stretched Spenders are similar to the Constellation segment Price Driven.

The data has several layers of segmentation that we've seen. Urban Professionals are high spending. They live in a small number of major cities and some student towns. They are 10% more likely to prefer Malbec than average. They are more likely to rely on tasting notes, recommendations and awards than average. Mature Foodies have a strong aversion to sweeter wines. Big Weekenders are most likely to enjoy sweeter styles.

I know we're flipping between countries a bit here, but if you're looking at secondary research you have to dig it out. The Vintrac survey of 10,000 regular wine drinkers in the US has six segments. And it’s updated regularly. And it has segments like Social Newbies, and Mainstream Suburbans.

So what do you do with this information?

First, look at where you can see opportunities for your brand that you're not already exploring.

Then think how you can make whatever wines you represent or market relevant to EACH of the segments. And think about which one you're able to make the most compelling case for. Because that's what we'll be doing as we look at targeting and positioning in the next two parts of the Masterclass.

Segmentation in practice

Now normally at this stage I'd want to show you an example. But here it's hard. Because the example of good segmentation is to show you targeting. And that's the subject of the next session.

Segmentation is about studying the whole pie.

Targeting is about selecting one slice.

Right now we need to make sure we stick to studying and segmenting the whole pie. So rather than a wine brand, let's look at an online platform set up to serve the whole pie, but in segments. Let’s look at how they segmented customers so they could target them more effectively and - ultimately - sell them more wine.

To continue reading consider one of the subscription options

Keep reading with a 7-day free trial

Subscribe to Joe Fattorini's Substack to keep reading this post and get 7 days of free access to the full post archives.